Classification will determine the likelihood of getting coverage as well as premiums. Market risk can be.

Any Loan if not repaidrenewed within the fixed expiry date for repayment will be treated as irregular just from the following day of the.

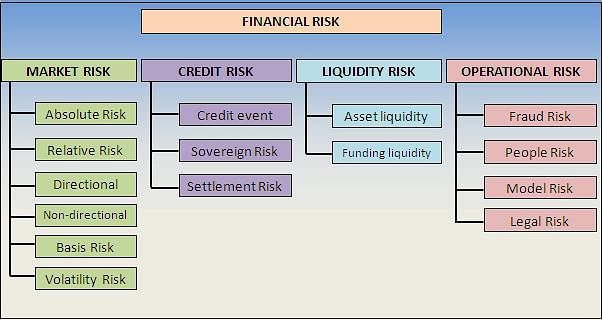

Classification of risk in finance. Types of Financial Risks. This type of risk arises due to the movement in prices of financial instrument. Market risk can be.

This type of risk arises when one fails to fulfill their obligations towards their counterparties. This type of risk. Danger is one-sided uncertainty.

Danger produces only bad surprises and its results arent measured in money or anything else that can be aggregated. Dangers should be minimised subject to constraints. Risk is a two-sided uncertainty both good and bad surprises are possible.

Classification and Types of Financial Risk in Banking Classification and Types of Financial Risk. As mentioned earlier we can see that most of the risks can be classified. Types of Financial Risk.

The risks that are classified under this subcategory are the ones that can cause direct. Market Risk Currency 3. Operational Risk Legal 4.

Market Risk Interest Rate 6. Fi nancial risk i s a risk of losing money due to a financial transaction on a financial asset or an economic operation with financial implications for example a sale on credit or in foreign currency. There are many risks some are specific others not but the vast majority class in risk below.

Risk classification can affect and be affected by many actuarial activities such as the setting of rates contributions reserves benefits dividends or experience refunds. The analysis or projection of quantitative or qualitative experience or results. Classification of risk 1.

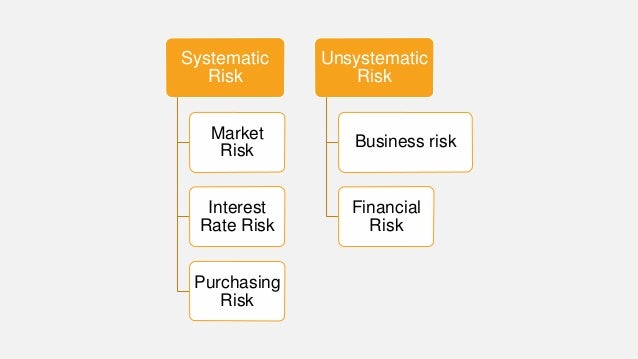

CLASSIFICATION OF RISK 2. Systematic Risk Market Risk Interest Rate Risk Purchasing Risk Unsystematic Risk Business risk Financial Risk 3. Market Risk is the risk that the value of an investment will decrease due to movements in market factors.

The reason for such uncertainty is market forces represented in two markets viz Bull Market. Risk Categories Definition Risk categories can be defined as the classification of risks as per the business activities of the organization and provides a structured overview of the underlying and potential risks faced by them. Most commonly used risk classifications include strategic financial operational people regulatory and finance.

In general financial theory classifies investment risks affecting asset values into two categories. Systematic risk and unsystematic risk. Broadly speaking investors are exposed to both.

Six basic executive finance functions are the following. All finance functions are concerned with the control of both cash flows and non-cash assets. The reason is easy to find out.

The finance managers must know how much cash will be tied up in various kinds of non-cash or non-liquid assets. 3 Types of Risk in Insurance are Financial and Non-Financial Risks Pure and Speculative Risks and Fundamental and Particular Risks. Financial risks can be measured in monetary terms.

Pure risks are a loss only or at best a break-even situation. Fundamental risks are the risks mostly emanating from nature. TYPES OF MARKET RISK Commodity risk or the risk that commodity prices ie.

Grains metals etc will change Interest Rate Risk is the risk that the relativevalue of a security especially a bond will worsendue to an interest rate increase. This risk iscommonly measured by the bonds duration. Classification of risk in insurance is largely based on the underwriting process where risks are evaluated.

Classification will determine the likelihood of getting coverage as well as premiums. Understanding your risk is important when applying for a policy since it helps you evaluate your challenges in getting a quote. Groups of households or communities.

Regions or entire country. Idiosyncratic risk independent Covariant risk. Catastrophic or systemic risk.

The classification consists of an alphanumeric designation of the form DNNNN where D stands for a capital letter A-Z and N are digits 0-9. The system is hierarchical. At the highest level are broad industrial sectors such as Manufacturing or Mining which are refined at two further levels ie.

Sector sub-sector and sub-subsector. Loan Classification Provisioning Policies Risk Management Framework Recovery Strategies of Eastern Bank. When the borrower fail to pay installments timely banks ranks the client in three classes according to the risk associated with the client.

Any Loan if not repaidrenewed within the fixed expiry date for repayment will be treated as irregular just from the following day of the. However in financial management risk relates to any material loss attached to the project that may affect the productivity tenure legal issues etc. In finance different types of risk can be classified under two main groups viz.