Sharpe Ratio is a very useful ratio to monitor the performance of mutual funds. Sharpe ratio is a measure of excess.

Sharpe ratio is a measure of excess portfolio return over the risk-free rate relative to its standard deviation.

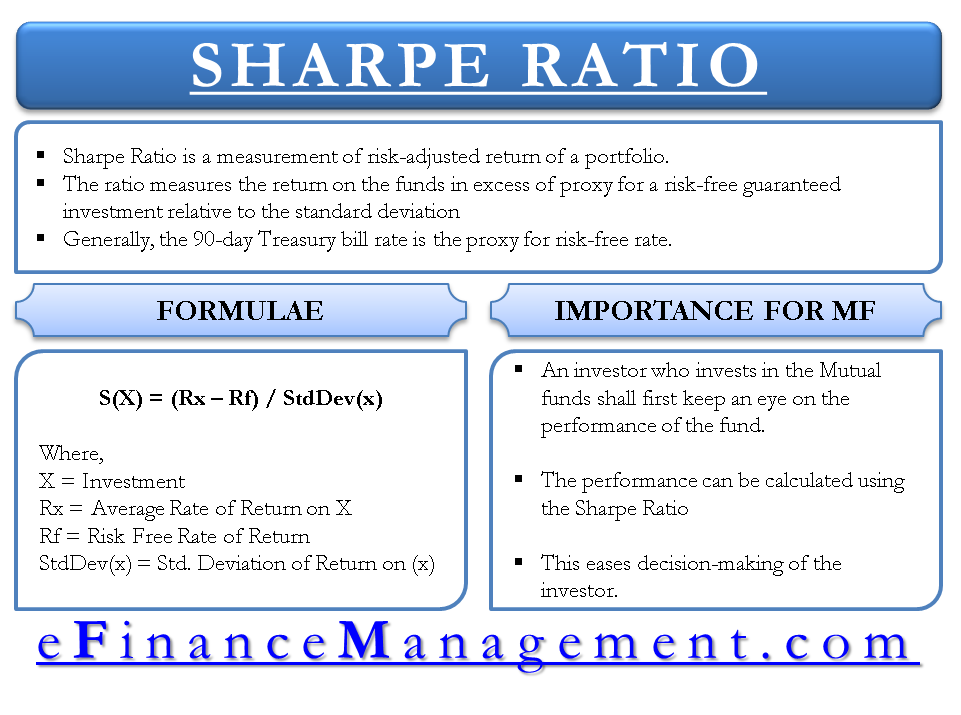

What is a sharpe ratio in a mutual fund. Sharpe Ratio is a very useful ratio to monitor the performance of mutual funds. Using this ratio investors can evaluate the relationship between risk and return of the fund. Sharpe ratio is used to measure the risk-adjusted returns of the fund.

The Sharpe ratio is often used to compare the change in overall risk-return characteristics when a new asset or asset class is added to a portfolio. For example an investor is considering adding a. The Sharpe ratio is a number that compares the return of a mutual fund with the volatility.

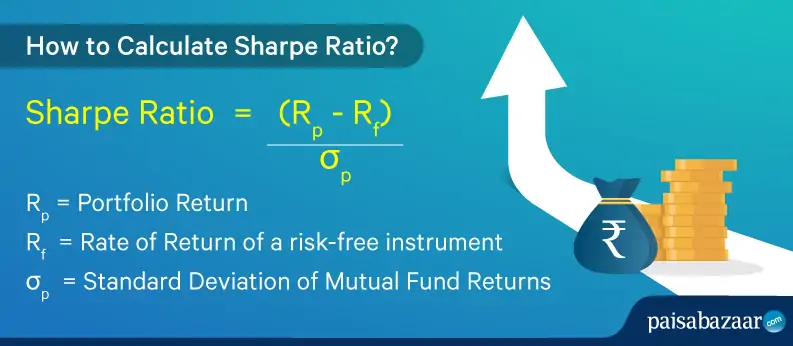

It is expressed as a ratio with the top half or numerator consisting of the average return on. The Sharpe ratio is a well-known and well-reputed measure of risk-adjusted return on an investment or portfolio developed by the economist William Sharpe. Sharpe Ratio Re Rf Sd It is a financial ratio which measures returns of a volatile asset like stocks mutual funds etc relative to the risk taken to generate those returns.

The formula for sharpe ratio is shown above. From the formula we can see how it. Sharpe ratio is an important mutual fund performance metric.

This is the second part of a series which focuses on a few important mutual fund performance parameters. The first part of the series focused on two important mutual fund parameters rolling returns and standard deviation. To show a relationship between excess return and risk this number is then divided by the standard deviation of the funds annualized excess returns.

The higher the Sharpe ratio the better the. The Sharpe Ratio measures the risk-adjusted return of a security. This is a useful metric for analyzing the return you are receiving on a security in comparison to the amount of volatility expected.

The historical sharpe ratio uses historical returns to calculate. The Sharpe ratio of a mutual fund measures a funds average return relative to the level of volatility experienced by the same. It indicates the value that a fund delivers for the risk it poses.

Sharpe ratio indicates if a fund will get you additional returns for your investment. Sharpe ratio helps in evaluating the additional returns after adjusting it to the risk of a fund. Sharpe Ratio of a mutual fund reveals its potential risk-adjusted returns.

The risk-adjusted returns are the returns earned by an investment over the returns generated by any risk-free asset such as a fixed deposit. However higher returns indicate extra risk. Sharpe ratio is a measure of excess portfolio return over the risk-free rate relative to its standard deviation.

If two funds offer similar returns the one. Sharpe ratio is a measure of excess. Ready to start investing.

You have to understand expense ratio index fund stocks and more. Learn how to get started by watching this video. This is where the Sharpe ratio comes into play.

Created by Nobel laureate William F. Sharpe the Sharpe ratio is one of the popular ways of measuring funds performances on. Sharpe ratio Return of the fund-Risk fee rateStandard Deviation of the fund The Sharpe ratio compares the excess return delivered by the fund over and above the risk-free return rate with its risk measured by Standard Deviation.

Higher the ratio the better it is. The Sharpe ratio of a mutual fund measures its average return relative to the level of volatility it experiences. Namaskar Dosto aaj hum bar krenge mutual funds ki ek aur risk measure ka yani Sharpe Ratio ka.

Aur janenge qa hota hai sharpe ratio kis kaam me aata hai sha. Sharpe Ratio Sharpe ratio is a measure of the risk adjusted performance of a fund. It is measured by the formula Average Fund return Risk free rate Standard deviation of the fund returns.